Stan Weinstein: BC RS vs. Mansfield Charts RS

Printed From: BullCharts Forum

Category: BullCharts

Forum Name: BullScript

Forum Discription: Technical discussion related specifically to the BullScript programming language.

URL: http://www.bullcharts.com.au/forum/forum_posts.asp?TID=985

Printed Date: 10 Mar 2026 at 9:00am

Software Version: Web Wiz Forums 9.69 - http://www.webwizforums.com

Topic: Stan Weinstein: BC RS vs. Mansfield Charts RS

Posted By: charlie_8

Subject: Stan Weinstein: BC RS vs. Mansfield Charts RS

Date Posted: 06 May 2015 at 4:20am

|

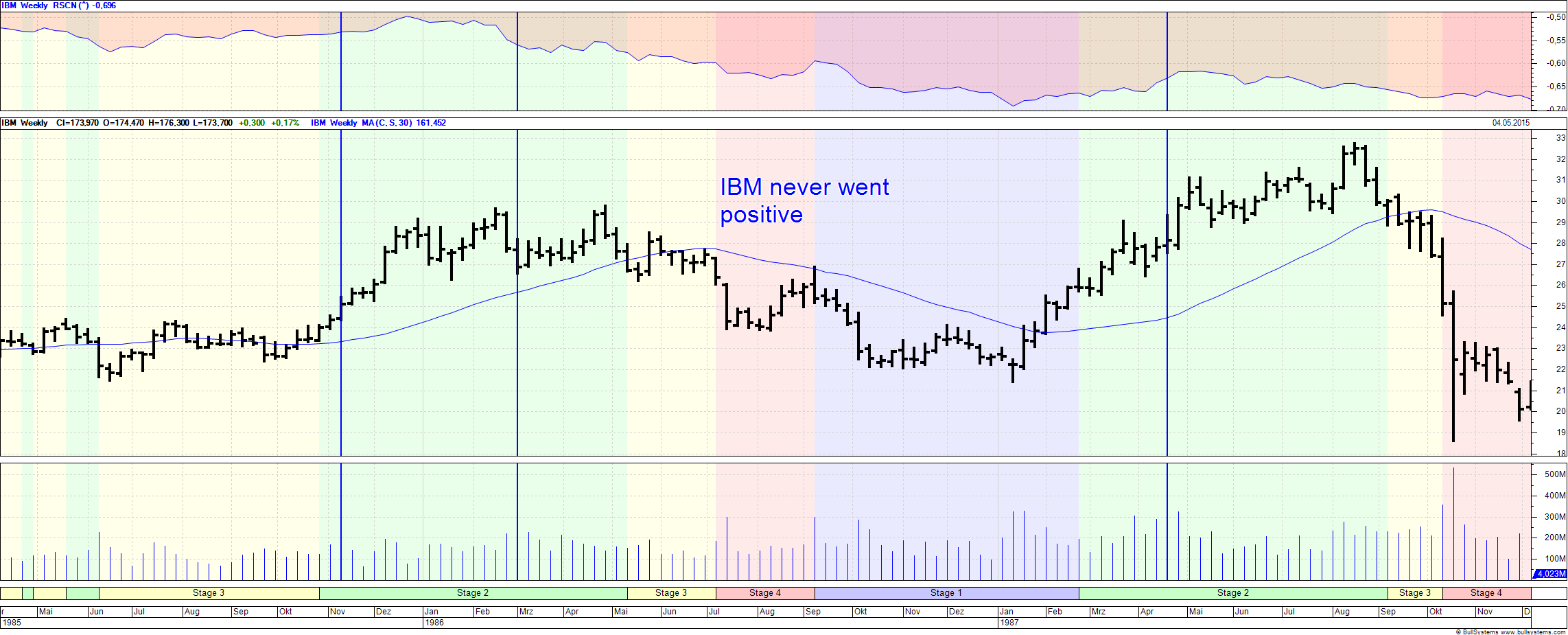

Hello dear BC users, a couple weeks ago I came across a Amibroker code, that seems to be a good reflection of original RS of Mansfield Charts. I don´t know, what data Mansfiled Chart used for benchmarking (I'm using S&P500 Index), may be they have used any industry or sector averages. I compared pictures of 2 stocks from the book (GT and IBM) with charts from Amibroker and BC. we could see more or less comparable results in Amibroker and totally disagreement with BC. :( here is the formula: ____________________________________________________ maPeriod = Param( "MA Period", 52 * 5, 0, 500, 1 ); rsSymbol = ParamStr( "Base Index Symbol", "^GSPC" ); rs = RelStrength( rsSymbol ); rsMan = ( rs / MA( rs, maPeriod ) ) - 1; dynColor = IIf( rsMan >= 0, colorLime, colorRed ); Plot( rsMan, "RS Mansfield", dynColor, styleArea ); ______________________________________________________       |

Replies:

Posted By: charlie_8

Date Posted: 06 May 2015 at 8:11pm

| I edited my post today, because all the pictures were lost. |

Posted By: cmacdon

Date Posted: 09 May 2015 at 8:26am

|

Charlie-8

I am not sure what Mansfied charts are about but there used to be a post I thought from BC, somewhere on this forum saying there was a problem with the Stan Weinstein stage indicators on BC; so, I would check with BC whether whatever the problem was, in that indicator, has since been fixed. ------------- BC User since June 2007 |

Posted By: paulchow2k

Date Posted: 03 Jul 2015 at 4:22pm

|

I used to think Relative Strength [Relative Compartive] is relative to the index of the country so if it's IBM, it's part of the DOW Jones ^DJI rather than the S&P 500 index. In Australia though that would have to be part of either the XJO or XAO although that being said, our market is so small we can just pull the index of that sector compared to the XAO/XJO index. p |