|

W D Gann's Stock vibrations and market structure |

Post Reply

|

Page 12> |

| Author | |

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Topic: W D Gann's Stock vibrations and market structure Topic: W D Gann's Stock vibrations and market structurePosted: 22 Aug 2014 at 8:05pm |

|

Here is a way to synthesise a few previous posts about Gann Case Studies, Market Structure and a way to focus in on W.D.Gann's concept of stocks having a particular vibration.

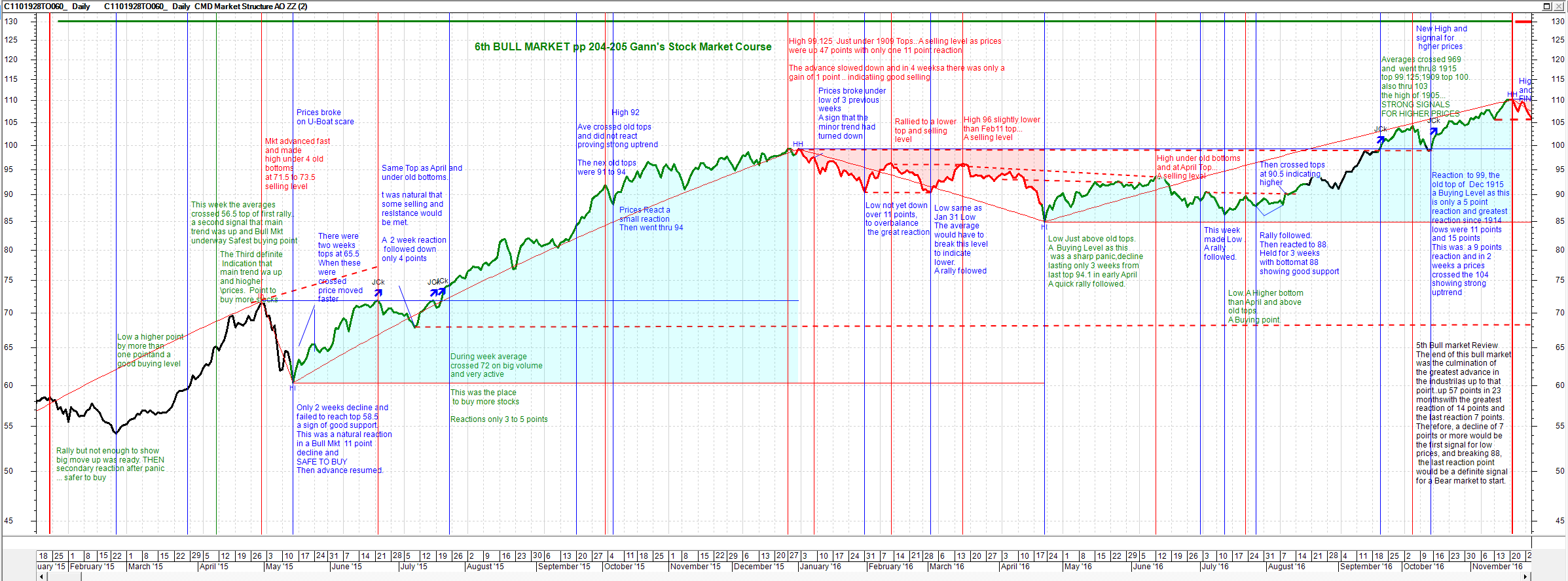

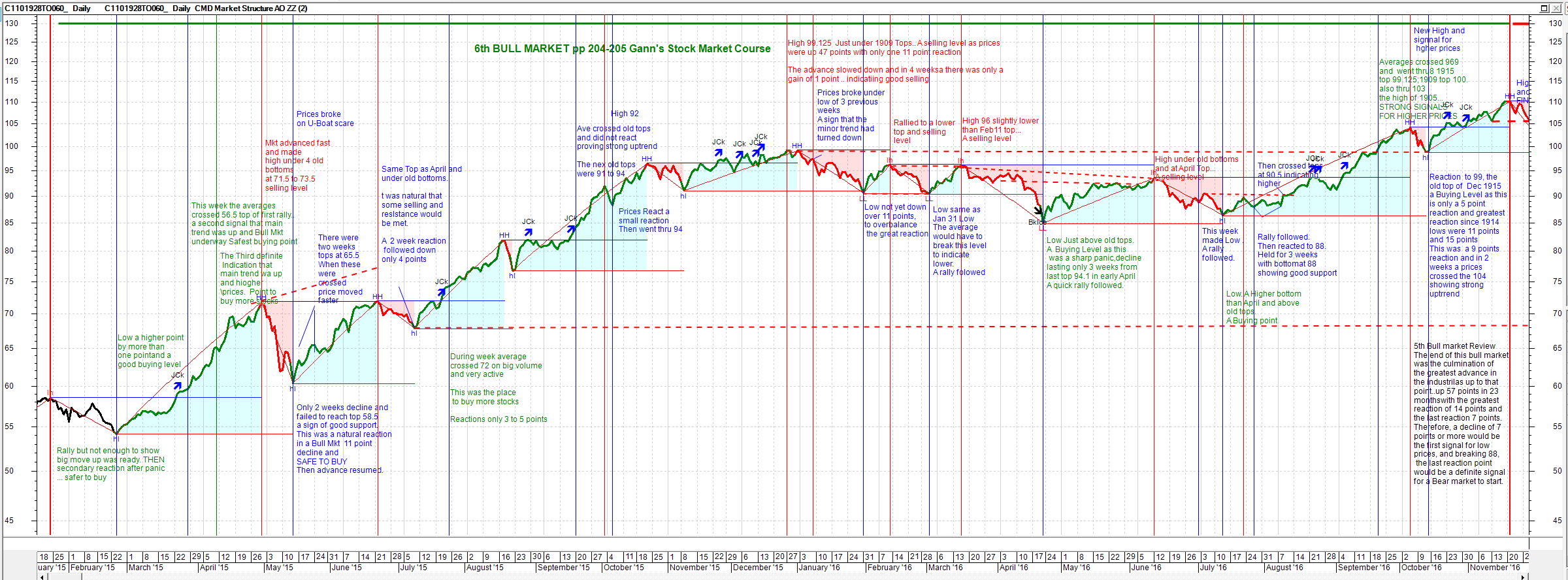

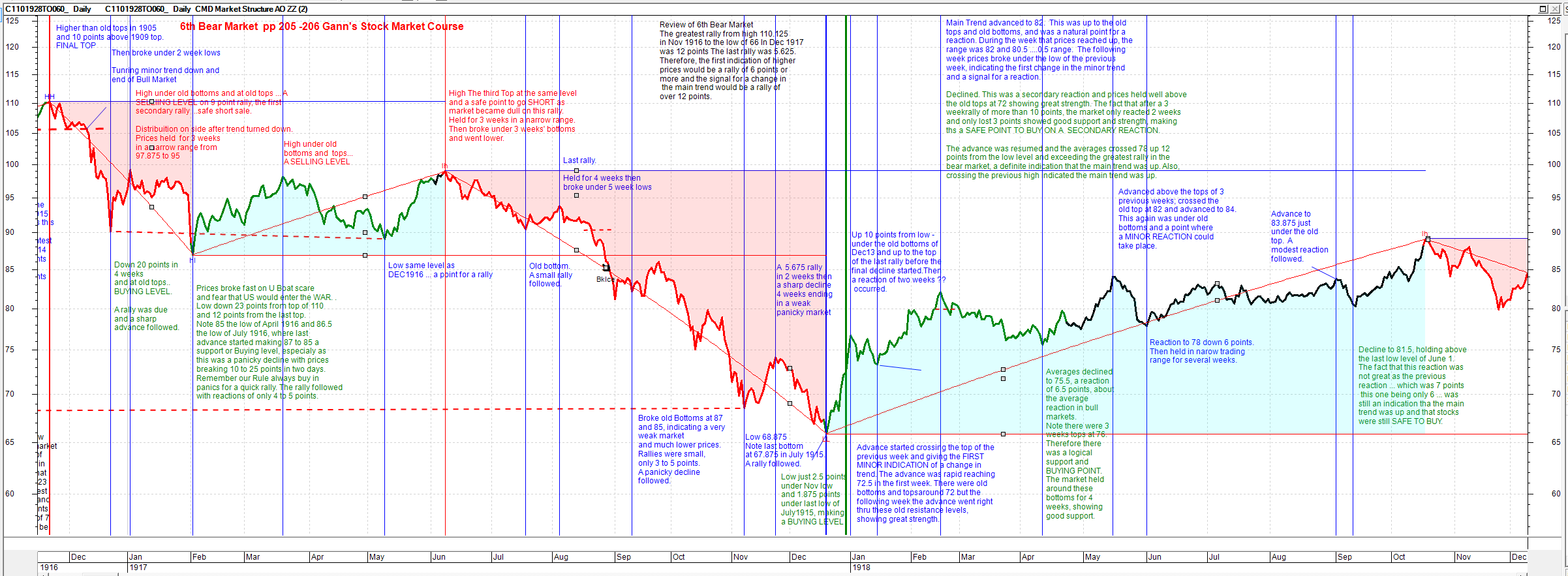

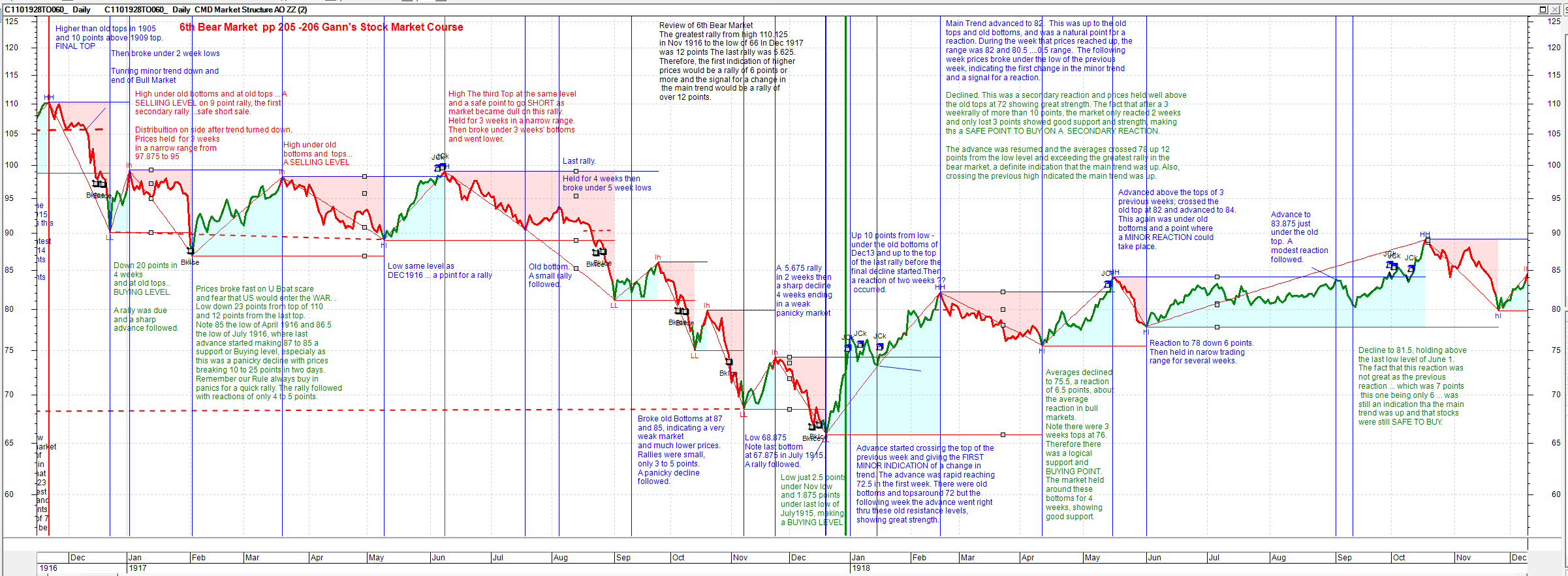

Gann did not really provide the formula for his vibration approach and there seem to be various hypotheses suggesting Astrological influences or Mathematical influences were the underlying basis for Gann's stock vibrations. So here is another partial concept. For this approach, I adapted a Slightly more flexible Market Structure indicator ( then previous market structure post) and applied it to the DJIA data which Gann commented on in case studies of a Bull and Bear Market campaign from 1915 to 1918 in his stock market course. I recall he did a similar case study covering later DJIA years in his book 45 Years In Wall Street. Reading the charts below, the comments relate to the point in time with a vertical line to the left of the comment. Some comments in green seem to be more general comments but they as typed exactly per the course albeit shortened comments in some instances. The qualitative verification of the appropriate vibration is being used is that the indicator set to the 5% vibration better reflects Gann's particular comments throughout the DJIA chart over the 3 years covering both the Bull and Bear campaigns. It is difficult to get further direct data for many of the other stock, commodities Gann discussed in his books and courses but DJIA data is obtainable back to the case study time. So, make up your own mind if the market structure and vibration indicator works. So,set out below is Gann's narrative for a Bull Market and Bear market campaign. I then applied either a 10% market structure indicator or a 5% indicator to the chart. The code for this Market Structure and vibration indicator is set out further below. It is same logic as previous post on Market Structure but with an alternative formula capable of picking up small or large vibrations (or %'s). Edited by cmacdon - 23 Aug 2014 at 1:42am |

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 22 Aug 2014 at 8:07pm Posted: 22 Aug 2014 at 8:07pm |

10% Vibration Edited by cmacdon - 23 Aug 2014 at 8:43am |

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 22 Aug 2014 at 8:10pm Posted: 22 Aug 2014 at 8:10pm |

5% Vibration Edited by cmacdon - 23 Aug 2014 at 8:44am |

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 22 Aug 2014 at 8:11pm Posted: 22 Aug 2014 at 8:11pm |

10% Vibration Edited by cmacdon - 23 Aug 2014 at 8:44am |

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 22 Aug 2014 at 8:18pm Posted: 22 Aug 2014 at 8:18pm |

5% Vibration Edited by cmacdon - 23 Aug 2014 at 8:45am |

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 23 Aug 2014 at 1:20am Posted: 23 Aug 2014 at 1:20am |

|

{Cmacdon note: Step I- Work out what is the market structure definition your are happy to work with. }

[Description="Cmacdon For this example, I adapted a different indicator, to use as the market structure engine and applied it to W D Gann's Bull and Bear campaign DJIA analysis see previous case study posts"] [target=price; Visible=True] [target=Price] Vib:=input("Vibration", 4, .001, 100); z:=Zig(If(Outside() AND Ref(H,-1)>Ref(H,-2),H,If(Outside() AND Ref(L,-1)<Ref(L,-2),L,If((Outside() OR Inside()) AND C>O,H,If((Outside() OR Inside()) AND O>C,L,If(H>Ref(H,-1),H,If(L<Ref(L,-1),L,If(Ref(H,-1)>Ref(H,-2),H,If(Ref(L,-1)<Ref(L,-2),L,C)))))))),Vib,%); ispeak := z>hist(z,1) and z>future(z,1); istrough := z<hist(z,1) and z<future(z,1); [linestyle=Solid; color=Red] z; Upfractal:=If(ispeak, H*1.001,undefined); Downfractal:=If(istrough{L<ref(L,1) and L<ref(L,-1)}, L*0.999,undefined); {Text for interpreting market structure showing positive Blue structure Higher Highs(HH)and higher lows (ll), and negative structure, Lower Lows (LL), and lower highs (lh)} [name=HH; linestyle=Text;fontsize=8; textalign=Above,Centre; color=Blue;] if(Upfractal>Valuewhen(2,Upfractal,upfractal), + "HH ", +""); Upfractal*1.001; [name=lh; linestyle=Text;fontsize=8; textalign=Above,Centre; color=Red;] if(Upfractal>Valuewhen(2,Upfractal,upfractal), + "", +"lh"); Upfractal*1.001; [name=LL; linestyle=Text;fontsize=8; textalign=BELOW,Center; color=Red;] if(Downfractal<Valuewhen(2,Downfractal,Downfractal), + "LL ", +""); Downfractal*0.999; [name=hl; linestyle=Text;fontsize=8; textalign=BELOW,Center; color=Blue;] if(Downfractal<Valuewhen(2,Downfractal,Downfractal), + "", +"hl"); Downfractal*0.999; {----------This draws Lines I called Creek and Ice (Wyckoff terms)for want of names-------} HoldLevelPeriod := Input("Hold Level Period",100,1); FrU:=ValueWhen(1,UpFractal,UpFractal); FrUb:=If(H < FrU and barssince(UpFractal)<HoldLevelPeriod, FrU, undefined); [name=Creek; linestyle=Horz Step; color=blue; width=1] FrUb; FrD:=ValueWhen(1,DownFractal,DownFractal); FrDb:=If(L > FrD and barssince(DownFractal)<HoldLevelPeriod,FrD,undefined); [Name=Ice; linestyle=Horz Step; color=red; width=1] FrDb; {-----------------------------Colour Market Structure--------------------------------------} Switch:=if(barssince(valuewhen(1,upfractal))<barssince(valuewhen(1,downfractal)),Frub,Frdb); { Fill } [name=Market Structure Fill; linestyle=fill;] [color=Red] If((L>valuewhen(1,FRUb)),H,Switch); [color=Cyan] C; [linestyle=pricecolor] [color=Green] If( c>=valuewhen(1,FRU) OR switch =FRD and c>valuewhen(1,FRD),1,undefined); [color=Red] If( c<=valuewhen(1,FRD) OR Switch = FRU and c<valuewhen(1,FRU) ,1,undefined); [color=Black] ; [Visible=True] jck:=Cross(C,Valuewhen(2,FRU)); [name=JCk; linestyle=marker; marker=Long;align=Above; ] jck; bki:=Cross(Valuewhen(2,FRD),C); [name=BkIce; linestyle=marker; marker=short; align=Below;] bki; Edited by cmacdon - 23 Aug 2014 at 8:42am |

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 25 Aug 2014 at 8:21pm Posted: 25 Aug 2014 at 8:21pm |

|

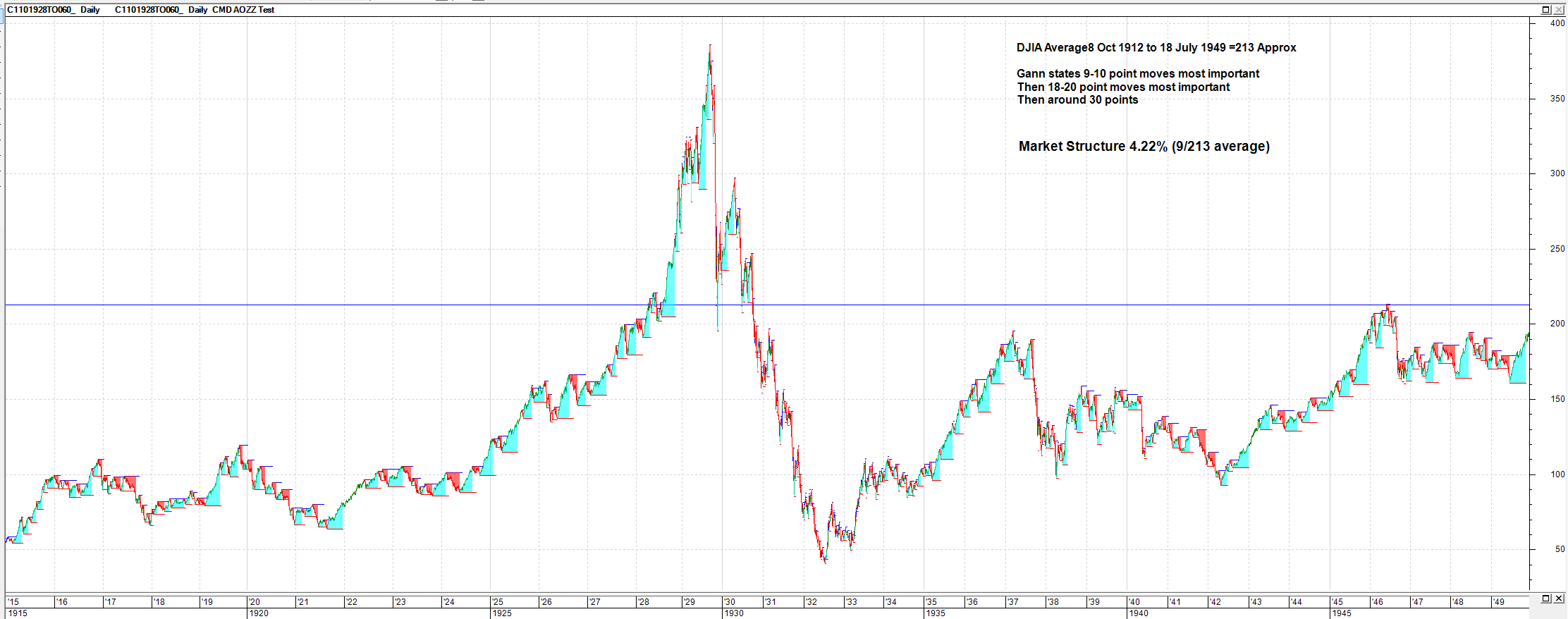

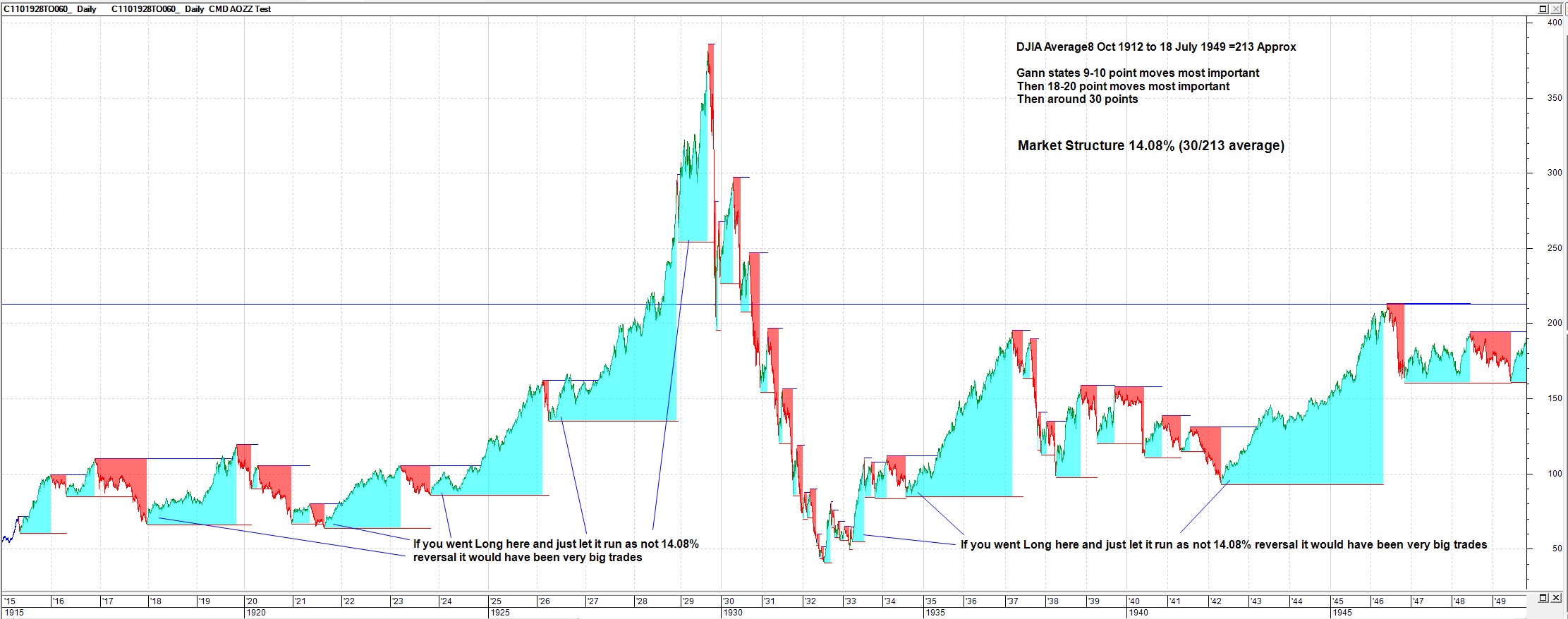

Here is some additional evidence that Gann was using 5% approx. swings on DJIA. In Chapter 6 of 45 years in Wall Street(see page 75 etc) Gann analyses the DJIA from October 1912 to July 1949 (see charts below) and states the 9 point Chart Swing is the most important and provides various statistics to support the DJIA was vibrating most around 9 points. After 9 to 10 points, he states the next most important is 18 to 20, and then around 30 points.

Over that period there was the build up in prices and Crash of 1929. The median point of the range for the 37 years appears to be about 213, (see Chart)so in percentage terms 9 points equates to 4.22% swing of the average and 30 points equates to a 14.08% swing on average. Applying the Market Structure indicator coded above, the two charts below are self explanatory of the DJIA covered by Gann's 37 year statistical analysis. The second chart indicates some positions where some very big long positions might have been taken using his guidelines using the 14.08% swings. Edited by cmacdon - 26 Aug 2014 at 4:09am |

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 25 Aug 2014 at 8:22pm Posted: 25 Aug 2014 at 8:22pm |

|

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 25 Aug 2014 at 8:23pm Posted: 25 Aug 2014 at 8:23pm |

|

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 26 Aug 2014 at 8:40am Posted: 26 Aug 2014 at 8:40am |

|

In this version 14.08% version (otherwise same as above) I extended the Hold level period from 100 to 1000

|

|

|

BC User since June 2007

|

|

|

|

Post Reply

|

Page 12> |

| Forum Jump | Forum Permissions  You cannot post new topics in this forum You cannot reply to topics in this forum You cannot delete your posts in this forum You cannot edit your posts in this forum You cannot create polls in this forum You cannot vote in polls in this forum |