|

Smart Money |

Post Reply

|

Page <12 |

| Author | |

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 29 Sep 2012 at 6:39pm Posted: 29 Sep 2012 at 6:39pm |

|

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 29 Sep 2012 at 6:38pm Posted: 29 Sep 2012 at 6:38pm |

|

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 29 Sep 2012 at 6:37pm Posted: 29 Sep 2012 at 6:37pm |

|

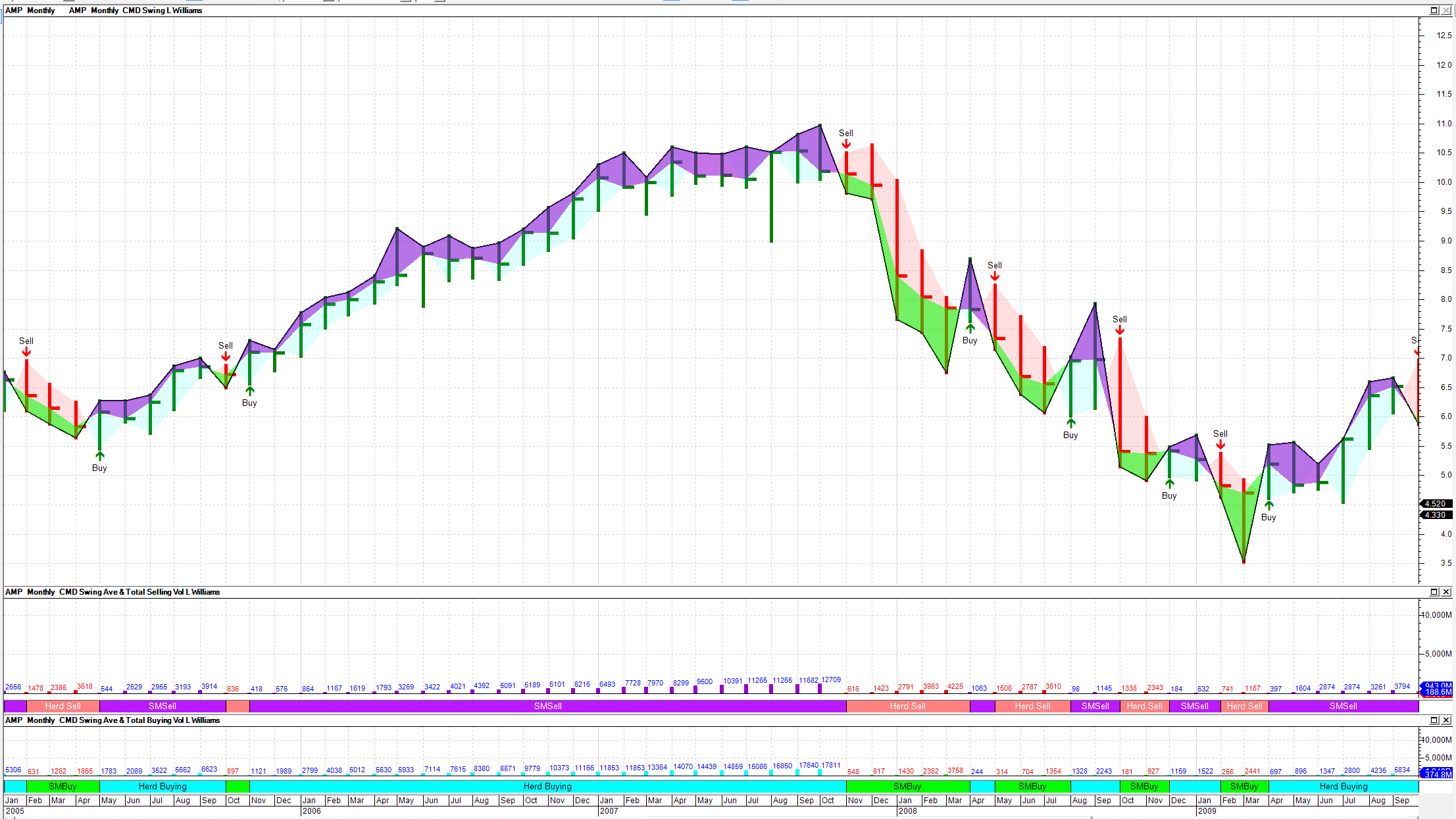

Tom

Williams writing about Volume Spread Analysis

(VSA) groups traders into Smart Money and the Herd. He advises that Smart Money have to sell

into uptrends and buy in to down trends which is the opposite of the way

traders normally think. This contrarian

concept has puzzled me for a long time.

Re-reading Larry William’s (no relation to Tom) book Long Term

Secrets to Short Term Trading, offers a possible solution. Larry Williams states that since 1965 his

operating rule has been “sellers in any time period are represented by the

price swing from the high of the day to the close, while buying is represented

by the close minus the low”, p.36, John Wiley & Co, 1999. I think Chaikin’s Money flow uses similar

concepts. So

here is how my new Bull chart template looks. I adapted as discussed further

below the Wave Volume indicator provided in other post re Weiss Wave. Two indicators are required. This is not any

sort of investment advice but education on writing the indicators. The charts show Buy and Sell becasuse the markers are set up to identify start and end of trend only. The

conceptual framework works reasonably well as good strong up trends tend to be

heavily coloured Cyan or Red as the Herd gathers momentum in Uptrends or panics

in down trends. When SM are heavily buying the downtrends the indicators tend

to show the down trend slowing or bottoming or when SM is heavily selling the uptrend tends to slow or stops

reasonably soon thereafter. Anyway,

something to play with. On

the Weiss Wave posts, I posted a formula for preparing a Bullcharts wave Volume

indicator. The changes needed for analysing

the wave volumes for “Smart Money” and the “Herd” is to change a few lines of

the previously advised formula as below. For

converting previous code to a SM Selling and Herd Selling average and Total Wave volume indicator. Add

Larry Willaim’s book reference above to the Citation area and add the following

new line to the code: Value1 := (((H-C)/(H-L))*Volume); {Selling Vol} And delete these two lines BuyVol2:=If(BuyVol,+1*v,0); TotalBuyVol:=If( BuyVol

,+1*v+prev(BuyVol2),0);} And replace by these two lines BuyVol2:=If(BuyVol,+1*Value1,0); TotalBuyVol:=If( BuyVol

,+1*Value1+prev(BuyVol2),0); And replace these two lines SellVol2:=If(SellVol,+1*v,0); TotalSellVol:=If( SellVol

,+1*v+prev(SellVol2),0); With these this two lines SellVol2:=If(SellVol,+1*Value1,0); TotalSellVol:=If( SellVol

,+1*Value1+prev(SellVol2),0); The above will give you the breakdown of

the selling wave Volume into a Smart Money Component and a Herd Component. For the Buying wave just copy the

amended formula, change the name to buying and Just replace the Value formula to the

formula shown below Value1 := (((C--L)/(H-L))*Volume); {Buying Vol} That’s it for the second Wave histogram. To check if you have done this correctly

the average on both these amended formulae will reconcile to the previous Wave

Volume formula. The ribbons shown on the charts are just subsets of the above amended indicators with Linestyle =Ribbon. Text for the amount of volume can be added if you want to show in text, as well as bars. |

|

|

BC User since June 2007

|

|

|

|

Post Reply

|

Page <12 |

| Forum Jump | Forum Permissions  You cannot post new topics in this forum You cannot reply to topics in this forum You cannot delete your posts in this forum You cannot edit your posts in this forum You cannot create polls in this forum You cannot vote in polls in this forum |